Hybrid Quantum

Our Hybrid Quantum Platform

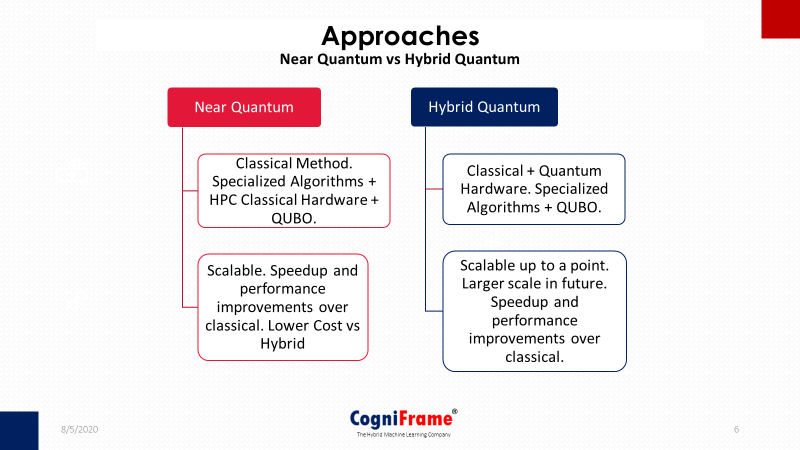

CogniFrame Operating Environment helps solve intractable and computationally intensive non-convex and stochastic optimization as well as simulation type problems. Multiple use-cases are supported for a number of leading organizations and our solutions set include Pure Quantum, Quantum inspired, and Hybrid Quantum based approaches. We can handle a number of problems at commercial scale.

Standard Classical Optimization algorithms take too long even to find good solutions. Multi-period optimization problems are NP-Hard. Quantum Computing has demonstrated advantages over classical methods. In fact, all classical risk problems can also be solved using Quantum once economic viability of pure quantum is established. Quantum represents the future direction.

We leverage the power of the most powerful Quantum hardware available today. Our focus is on threshold optimization to solve problems that are NP Hard and solving Simulation problems using a Simulated Quantum Approach.

Our Solutions

Feature Selection

CogniFrame’s OFS Algorithm helps helps solve what is traditionally considered an NP-Hard problem (due to high dimensionality) and It helps reduce features of the data without losing on quality of outcome leading to improved Machine Learning Training Time. It also helps uncover mutual information between weaker features that cannot be uncovered using traditional approaches and existing algorithms optimally.

Read MoreOTP and Crypto Key

CogniFrame’s OTP generator function is a gate simulator-based quantum random number generator, which uses quantum principles of superposition and entanglement to generate the OTPs. The cryptographic secret key (CSK) consists of a series of bits used to both encrypt the plaintext message into ciphertext message and decrypt the ciphertext message into the initial plaintext message. It is also called a symmetric key as it uses the same key both for encryption and decryption. CogniFrame’s CSK can generate random CSKs of a large length with speed and enough statistical randomness to prevent attackers from hacking the key and obtaining access to information shared during the cryptographic process.

Read MoreDrug Discovery

Working with a leading global research institution, CogniFrame has designed a solution that can potentially significantly reduce drug discovery efforts and costs.

Read MoreCollateral Optimization

The solution focuses on minimizing the cost associated with trades and collateral deployment while maximizing profitability. In a centralized collateral environment, the application solves the collateral management and allocation problem.

Read MoreDiverse Solutions

We support a number of other optimization and simulation problems such as feature selection, index tracking, drug discovery, genomics, security, etc.

Read More